VA State Tax Credits: NAP & EISTCP

Save Money While Supporting our Scholarship Program

Save Money While Supporting our Scholarship Program

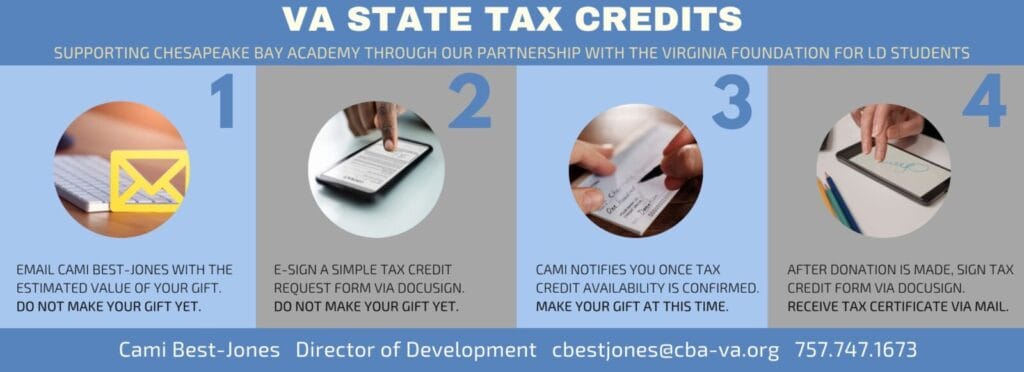

Many children who learn differently are in need of some extra financial support to attend Chesapeake Bay Academy (CBA). CBA participates in the Neighborhood Assistance Tax Credit Program (NAP) and the Education Improvement Scholarships Tax Credit Program (EISTCP) through the Virginia Foundation for Learning Disabled Students (VFLDS). Gifts directed for the purpose of providing scholarships to low-income, learning-disabled students may be eligible for Virginia state tax credits up to 65%. CBA is pleased to offer this benefit to our donors, as credits are available.

The Education Improvement Scholarships Tax Credits program increases private school access for Virginia’s children in need. It offers a 65% state tax credit on top of current state and federal tax deductions for monetary and marketable securities donations to nonprofits that, in turn, provide private school scholarships.

Chesapeake Bay Academy, through the Virginia Foundation for LD Students (VFLDS), provides scholarships to students meeting the prescribed criteria as defined by the Virginia Department of Education for the Education Improvement Scholarship Tax Credits.

Requirements for eligibility can be found on the Virginia Department of Education website at: https://law.lis.virginia.gov/vacode/58.1-439.25/